If we’re going to talk about AI in benefits, I thought we start with understanding where benefits even came from.

It may be to no one’s surprise that our modern benefits systems weren’t really designed, they simply evolved out of necessity. And that history still explains a lot about why things are so complex today.

Employee Benefits Evolution During World War II

During World War II, the U.S. government aimed to maintain economic stability through the Stabilization Act of 1942. Through this law, an executive order authorized President Franklin D. Roosevelt to freeze wages, salaries, and prices to curb inflation during the war.

Since employers couldn’t offer wage increases and skilled labor was scarce with millions deployed, companies had to find creative ways to attract and retain workers.

The solution? Fringe benefits. These were non-cash, indirect compensation like health insurance, pension benefits, paid holidays, and sick leave.

What Type of Health Insurance was Being Offered?

Back then, “health insurance” looked very different from what we know today:

- It was hospital coverage, not full medical care

- Employers primarily partnered with Blue Cross (for hospital stays) and later Blue Shield (for physician services)

- It didn’t include dental, vision, disability, or wellness. These benefits came much later

- It was community-rated, meaning everyone paid the same rate regardless of age or health

The first big breakthrough came when the IRS ruled in 1943 that employer-paid health insurance premiums were not considered taxable income to employees.

That single decision made health benefits financially attractive to both employers and workers, solidifying the employer-based health system we still have today where most private health coverage is tied to employment.

How This Connects to Today

The irony is that those wartime rules created a temporary workaround that became permanent. Granted, in a good way, it created benefits that didn’t exist before.

But the entire healthcare and benefits ecosystem was built for a completely different economy:

- One where people stayed with one employer for decades

- One where modern data systems weren’t a thing

- One where compliance complexity didn’t yet exist

Every innovation since, from disability insurance to 401(k) plans, has been layered on top of that foundation, instead of being redesigned. And yes, a redesign is not easy.

So today’s “benefits systems” aren’t broken by accident. They’re working exactly as they were originally built to work at the onset.

Bringing it back to AI

If we’re going to introduce AI into benefits, we can’t just look at what’s broken. We have to understand why it was built this way in the first place — and what parts of that design no longer fit how we work today.

Next Up: The Rise of the Modern Workforce – From Fringe Benefits to the Era of Security.

We’ll look at how post-war optimism, union influence, and a changing workforce transformed benefits from a simple incentive into a symbol of stability and care.

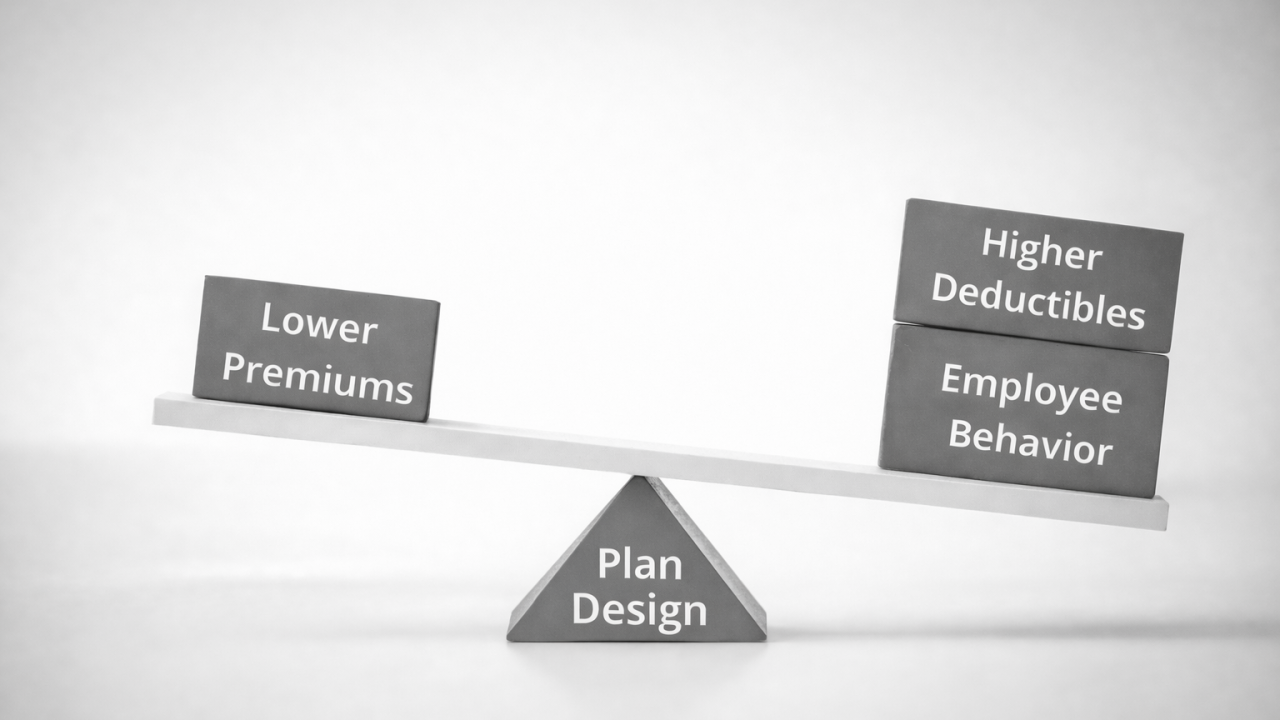

Question for you: If you could rebuild one part of the benefits world from scratch, where would you start? Plan design, data, compliance, or something else entirely?