So far in this series, we’ve been tracing how “security” once felt – the loyalty, the long-term promises, the stability of an era where work and benefits moved in predictable patterns.

But behind every promise was something less visible and far less glossy:

- Math

- Risk

- Assumptions about human behavior

Before we talk about 401(k)s, portability, or AI, we need to understand the middle layer – the layer that quietly held the entire system together.

Employee benefits work because underwriting makes the risk manageable – and that’s just as true today as it was then.

The Role of Underwriting: Turning People Into Probabilities

I remember my teacher in college, Mr. Treadway, teaching me probability theory until it finally clicked. He was patient, generous, and made the math feel human, even though the world of probability rarely is.

Underwriting is the process insurers and actuaries use to calculate risk – the financial backbone of pensions, health coverage, life insurance, and every benefit offered today.

At its core, underwriting answers three questions:

- How long will people work?

- How long will they live?

- How much will it cost to maintain the promised benefit?

And to answer those questions, companies rely on:

- Mortality tables

- Tenure patterns

- Investment return assumptions

- Salary growth curves

- Inflation models

The methods haven’t changed much, but the world they were built for has. The assumptions used to be somewhat predictable. Today, they’re far more fluid.

When The Math Worked – And Why It Started to Strain

In the mid-1950s, when employers began widely offering employee benefits, underwriting was grounded in a world that felt far more predictable:

- Employees often stayed 30–40 years

- Jobs didn’t shift every few years

- Companies grew steadily

- Markets were relatively stable

The assumptions generally matched reality, so the math held.

But by the 1970s, those assumptions began to crack:

- People were living longer than the tables predicted

- Tenure dropped

- Investment returns fluctuated

- Companies restructured

- Entire industries collapsed

- Inflation soared

The numbers no longer matched the world they were meant to model.

When I started my career in 2002 as a pension actuarial analyst, much of the work wasn’t building pensions. It was redesigning, cutting, or freezing them because the original assumptions no longer held.

The numbers were telling the truth long before society caught up.

Underwriting Didn’t Just Shape Pensions – It Shapes Everything

Underwriting is still the engine behind:

- Health insurance premiums

- Stop-loss coverage

- Life insurance

- Disability plans

- Risk pooling across populations

- Employer contribution strategies

- Claims reserves

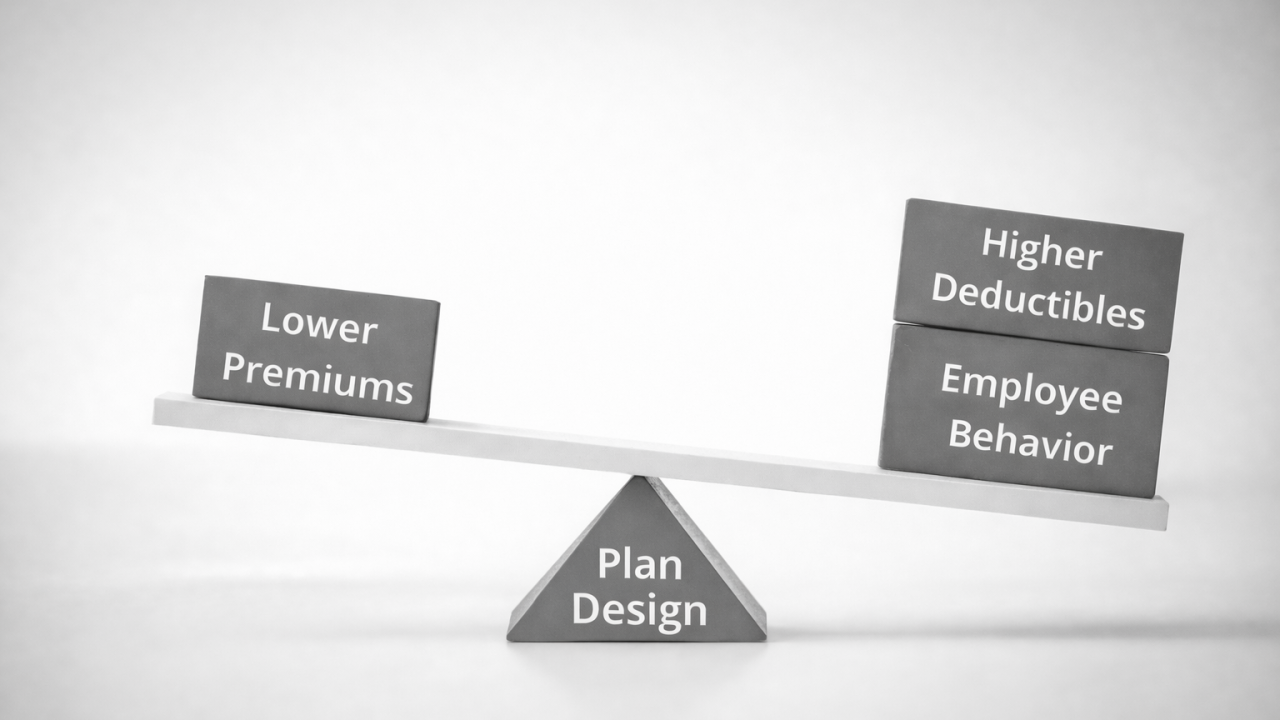

Underwriting determines what’s possible in benefits. It always has. It is still the only way to price risk, forecast costs, and decide what employers can offer.

What changes, and what strains the system today, are the assumptions underwriting relies on: tenure, stability, returns, mortality patterns, and changing family dynamics.

Why This Matters for AI

AI won’t replace underwriting. But it will change the inputs.

Imagine AI being used in the underwriting process to:

- Detect patterns humans miss

- Support decisions that reflect real-time behavior

- Predict trends earlier

- Identify inequities in assumptions

- Simplify the complexity hidden inside actuarial models

AI can help with a more modern and accurate version of how we understand risk.

What do you think is holding AI back in underwriting today – data quality, regulation, or the way our systems were originally designed?

Next Up

From Promises to Portability – How 401(k)s Redefined Security.

We’ll look at how the move from defined benefit to defined contribution shifted responsibility from employers to individuals – and why it changed everything about trust, risk, and the future of benefits.