In our last post (The Shift to Portability) , we talked about portability, how work became more mobile, and how benefits shifted to follow people rather than keep them anchored to one employer.

That shift made benefits more flexible. It also made the underlying structure matter more.

- Before enrollment.

- Before data moves.

- Before automation or AI.

Let’s slow down and look at the foundation.

Benefits Are Not Products

We often talk about “benefits” as if they are things you buy and move on from.

- Health insurance.

- Retirement.

- Life insurance.

- Disability coverage.

But benefits are not products. They are systems of rules, legal requirements, and operational procedures.

- Before an employee enrolls.

- Before a carrier is selected.

- Before any data moves.

A benefit plan has already been defined.

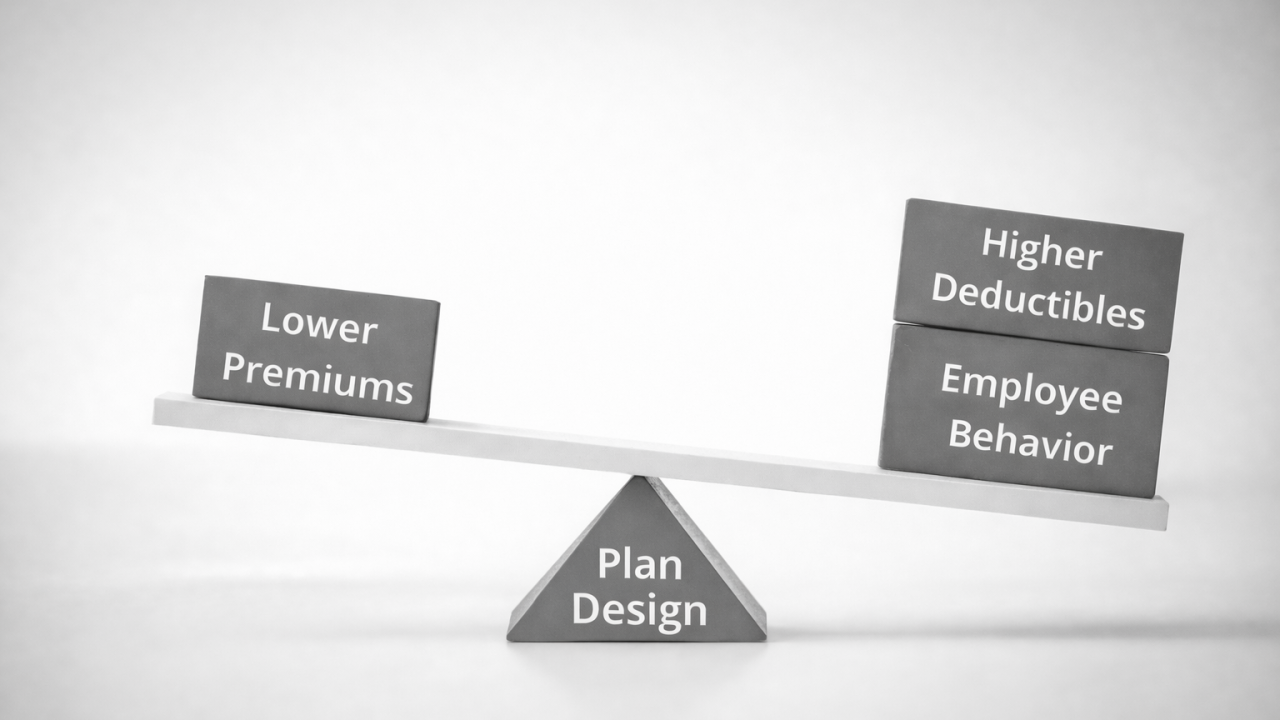

The Invisible Layer Beneath Benefits – The Plan Design

A benefit plan is a set of decisions translated into structure. It defines:

- Who is eligible, and when

- What is covered, and what is excluded

- How costs are shared

- When changes are allowed

- What qualifies as a life event

- How dependents are defined

- How long coverage lasts

This is plan design.

These decisions live in plan documents, summary plan descriptions, and configuration tables. They are legal, financial, and operational by design.

Once they’re set, everything else follows.

Plan Design Is Where Complexity Begins

Every plan design choice creates downstream impacts:

- A waiting period affects onboarding

- Eligibility tied to hours depends on payroll data

- Tiered coverage affects contributions

- Multiple plan options affect enrollment logic

- Life event rules shape how benefits are administered

None of this is visible to employees. But all of it shapes their experience.

Plan design is where intent is defined, long before execution begins.

What These Rules Look Like in Practice

Most plan decisions do not sound complex when they’re made.

- “Waiting period” could be 30 days from hire or immediately eligible.

- “Benefits eligibility” is based on hours worked.

- “Dependents” must meet a definition.

But once these decisions are put into action, the details matter. In practice, those choices translate into:

- Effective dates, which determine whether coverage starts on date of hire or the first of the month following hire

- Hour-based eligibility, which relies on data from payroll and timekeeping systems

- Dependent definitions, which determine whether a family member is covered or denied

- Life event rules, which define when changes are permitted and how they’re enforced

When something breaks in the enrollment system, plan design should be the first place to check.

In theory, systems should do exactly what the plan tells them to do. If the design is well understood, configuration and system logs are the next place to look.

Before Data. Before Systems. Before AI.

When benefits issues show up, teams often jump straight to:

- Enrollment problems

- 834 files

- Automation

- “The system is broken”

That’s where issues surface. But it’s rarely where the answers live.

What I see most often is something breaks, and troubleshooting starts immediately in the system.

- The file is questioned.

- The configuration is blamed.

- The vendor is escalated.

- The AI “isn’t working.”

Meanwhile, the plan document, eligibility rules, or underlying data often already explain what’s happening.

- Systems don’t invent rules. They execute them.

- Data doesn’t make decisions. It reflects them.

- Automation doesn’t resolve confusion. It scales it.

Even once AI is implemented, it can’t accurately reason about benefits unless the rules it’s interpreting are correct, clearly defined, and supported by clean data.

To understand how a benefit works, the source is not the system. It’s the plan document and the plan design behind it. Systems don’t decide benefits. They interpret and apply the rules they’re given.

Question for You

When benefits issues show up in your organization, how often do they trace back to plan design decisions?

Next Up: Benefits as Strategy

Now that the structure is clear, we’ll look at how employers actively use plan design to balance cost, risk, and employee experience, and why benefits became a lever, not just a promise.